by Dr. Kelley Cullen

Buying a house, especially for the first time, signals a family’s commitment to the community and reinforces a pattern of employment and consumption that fosters growth and stability in the local economy. Prior to the pandemic, lower interest rates and economic growth, accompanied by lower unemployment, made owning a home within reach for many. However, a much stronger demand has now exceeded supply . Consequently, prices of houses, including those below the median typically deemed to be within reach of first-time buyers, rose faster than incomes, making housing less affordable in many parts of the state, including the two counties.

The problem has been further complicated by the onset of the pandemic which sent many people into lockdown in their current homes and initially, at least, slowed construction of new houses. As many people moved to working remotely, they chose to renovate existing homes, adding home offices and work spaces and making them less likely to sell. All of this further reduced supply and drove up prices, making it even more difficult for a first-time home buyer to be able to afford a mortgage.

Because it is important for a community to have and maintain affordable housing, especially for first-time home buyers, indicator 6.3.3 Housing Affordability Index for First-Time Homebuyers (FTHAI) tracks this on the Chelan & Douglas County Trends, using data from the Washington Center for Real Estate Research (WCRER). Assuming that first-time homebuyers will purchase a less expensive home, face a lower down-payment, and report a lower income than area averages, this indicator produces a ratio of below median incomes to below median housing prices. In particular, the Index measures the ability of a “starter” family, as measured by household income at 70% of the median, to purchase a first home having a price that is assumed to be 85% of the area's median price. The ratio further assumes a 10% down payment and a 30-year fixed mortgage.

When the index value is 100, this implies a household spending exactly 25% of its income on financing its first home (including mortgage principal and interest along with property taxes). When the index is above 100, the household’s income is more than sufficient to pay the mortgage expenses. Conversely, when the index drops below 100, the burden of the mortgage expenses comprises more than 25% of income and housing is said to less affordable for first-time buyers.

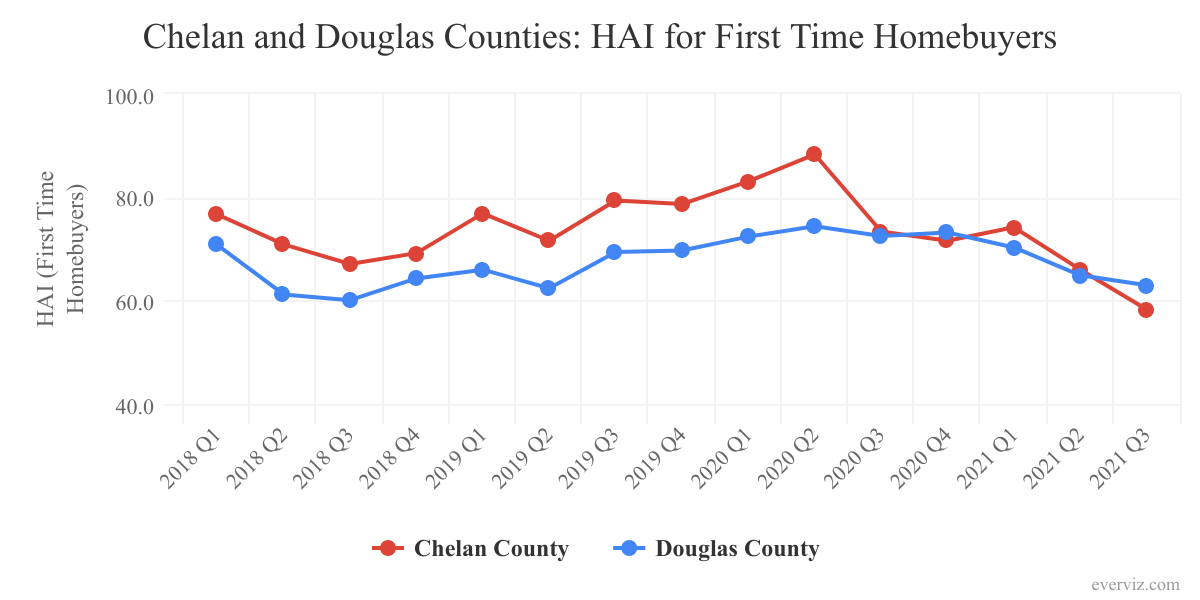

Since 2015, 38 out of 39 counties in the state of Washington have seen housing affordability for first-time buyers worsen and presently only 10 out of the 39 counties have index values above 100. The FTHAI for Washington State had been largely unchanged through 2019 and 2020 at around 80, but dropped in 2021 to its current 67. The combined counties of Chelan & Douglas have trended very closely to that state average but recently dropped to 60, implying that although housing for first-time buyers has gotten less affordable across the entire state, it is even less affordable in the two counties. In fact, the current index value in the two counties is the lowest among Eastern Washington metropolitan areas. The next lowest county in affordability is Spokane with an FTHAI of 65.

Although prior to 2020, Chelan County was slightly more affordable, after the third quarter of 2020 it is trending exactly with the combined county average. Douglas County, on the other hand, was less affordable prior to the middle of 2020 (74.4 vs. combined counties of 83.4), but as of the third quarter of 2021 is now slightly more affordable (63) than the combined counties average (60).

The good news is that that even though housing has become less affordable for first-time buyers, homeownership rates for the two counties are still above the state and national averages and have not been falling (yet) as some might predict. See this Trends indicator for detail.

To understand why the FTHAI has been falling here (implying less affordability for first-time buyers), one has only to look at the two components of the ratio used in creating the index – below median income vs. below median housing prices. Median household incomes for the combined counties was $60,873 in 2019 (most recent year of data), below the state average of $78,687. In the urban parts of the counties, Wenatchee and East Wenatchee have median household incomes even lower at $53,167 and $54,223 respectively. From 2016 to 2019, the median household income in the two counties rose 16.5%. This is viewable in this Trends indicator.

Unfortunately for first-time home-buyers this increase in incomes has been outpaced by the increase in the median home resale value which has been on a higher trajectory, especially since 2017. In third quarter of 2016 the median home resale value in the combined counties was $258,079; in the same quarter of 2021 it reached $510,807 – almost doubling in price (98% increase) over the five-year period. The median home resale price of a home in Chelan County for the most recent quarter was $541,200 and for Douglas County, $455,200! See these dramatic increases here. These were higher even than Spokane County which has seen a very hot housing market and currently shows a median resale price of a home of $413,700.

With interest rate increases on the horizon and rising inflation, the challenges to first-time home-buyers facing tighter budgets and less robust credit histories may become even worse before they get better.